This article is published in Aviation Week & Space Technology and is free to read until Jul 22, 2024. If you want to read more articles from this publication, please click the link to subscribe.

CHICAGO—Spirit AeroSystems will need to shed part of its aftermarket business as part of the planned acquisition by Boeing, announced on July 1—particularly at places that produce Airbus parts.

Its facility in Belfast, Northern Ireland, which manufactures the Airbus A220's wing, is one of those. That site also includes a sizable MRO business that performs Airbus repairs, which means it is on the “divestiture list for Spirit,” says Kailash Krishnaswamy, senior vice president of Spirit’s aftermarket division. He says the Belfast facility buyer could be Airbus, Boeing or a third party.

Meanwhile, Spirit's MRO business in Casablanca, Morocco, on a site that also includes an A350 fuselage manufacturing facility, is on the list to go to Airbus because the OEM is interested in the whole site, he says.

“A lot of what’s happening with the Spirit divestiture is happening on the site level, so each site either goes to Boeing or Airbus, as previously disclosed, or it will go to a third party,” Krishnaswamy says.

When Spirit AeroSystems realigned its business in 2021, it divided it into commercial, defense and space, and aftermarket divisions, with revenue targets of 40%, 40% and 20%, respectively. That year was the first calendar year it operated the sites in Belfast and Casablanca, as well as a site in Dallas, all three of which it acquired from Bombardier in late 2020.

Shortly after Spirit's internal realignment, the aftermarket piece was only 2-3% of the company’s total revenue, but it has steadily grown by double digits in the past few years through expanding its capacity and capabilities to get closer to its customers.

In 2021, Spirit’s aftermarket revenue was $239.9 million whereas by 2023 it had reached $373.9 million, which was 20.1% higher than in 2022.

Some of the aftermarket expansions include:

- Making GAMECO in China an authorized Spirit service center in 2022.

- Opening a joint venture with Evergreen Aviation Technologies in October 2022 to provide MRO solutions for various Airbus and Boeing nacelles and flight controls.

- Signing an MOU with Malaysian Airlines for composite repairs in 2022.

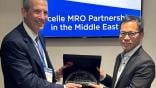

- Setting up a nacelle MRO partnership with ST Engineering in the Middle East in 2023.

- Adding Joramco in Jordan as an authorized service center for structural repairs in 2023.

- Signing a structural repair agreement with Vietnam Airlines Engineering Ltd. Co. (VAECO) to provide on-demand engineering support in 2023.

- Adding GMR Aero Technic in India as an authorized service center in 2023 and then in early 2024 signing a strategic partnership agreement with it to create a nacelle repair service in Hyderabad.

These commercial partnership agreements are all part of the Boeing piece of the acquisition.

“I think most of the aftermarket will stay together,” Krishnaswamy says.